33.630133

-117.872168

0

Image

—

Posted: October 15, 2013 in divorce

Tags: Certified Public Accountant, Child custody, Divorce, Divorce in the United States, family, financial planning, marriage, Mediation, separation

Image

—

Posted: September 25, 2013 in Uncategorized

Tags: children, cpa, custody, Divorce, family, finance, marriage, Mediation

Job Hunting Expenses

Posted: September 6, 2013 in Job HuntingTags: career search, cpa, executive search, headhunters, income tax, job hunting, job search

September is often a time of transition, when people decide to make major life decisions–such as changing jobs. If you’re looking for a new job, then you may be able to claim a tax deduction for some of your job hunting expenses–as long as it’s in your same line of work.

Here are seven things you need to know about deducting these costs:

1. Your expenses must be for a job search in your current occupation. You may not deduct expenses related to a search for a job in a new occupation. If your employer or another party reimburses you for an expense, you may not deduct it.

2. You can deduct employment and job placement agency fees you pay while looking for a job.

3. You can deduct the cost of preparing and mailing copies of your resume to prospective employers.

4. If you travel to look for a new job, you may be able to deduct your travel expenses. However, you can only deduct them if the trip is primarily to look for a new job.

5. You can’t deduct job search expenses if there was a substantial break between the end of your last job and the time you began looking for a new one.

6. You can’t deduct job search expenses if you’re looking for a job for the first time.

7. You will usually claim job search expenses as a miscellaneous itemized deduction, but can deduct only the amount of your total miscellaneous deductions that exceed two percent of your adjusted gross income.

Give us a call if you have any questions about tax deductions related to a job search.

4540 Campus Drive Suite 118

Newport Beach, CA 92660

Fax: (949)250-3012

Phone: (949)419-6500

info@vallecpa.com

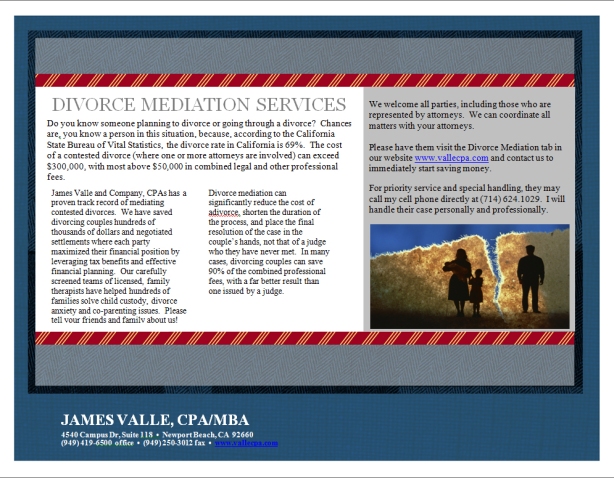

The importance of divorce planning

Posted: August 6, 2013 in UncategorizedTags: business, Certified Public Accountant, Dispute resolution, Divorce, Divorce in the United States, Family law, finance, financial planning, Law, marriage

Over many years of professional practice, we have found a vast majority of our clients have suffered from the results of poor divorce planning. Often times, both parties could have avoided the pitfalls of a bad divorce, had they planned for the divorce BEFORE hiring attorneys and filing for divorce. Often times, the adversarial nature of the attorney led divorce leads to costly fighting over issues on a piecemeal basis. This results in a very expensive, lengthy and uncoordinated battle between the parties which usually leads to a marriage dissolution that minimizes the combined net wealth of the parties. Effective divorce planning considers all aspects of tax, estate, and financial planning while coordinating the future needs of the children (if any), and maximizing the combined net worth of the parties in a fair and balanced way. We offer one or both parties effective divorce planning strategies to help minimize the effects of divorce.

James Valle & Company, CPAs has specially trained CPA/MBAs with extensive business management skills that can easily understand the inner workings of a family business and can assess valuation and operational requirements. These mediators have a proven track record of highly contested dispute resolution. They are specially trained in tax and financial management and can help each party minimize their tax and maximize their wealth, despite the hardships caused by divorce.

Certified Public Accountants have a duty and ethical requirement to maintain independence from the parties. They don’t take sides. This fully ingrained attribute ensures fair and balanced treatment for both parties.

@JamesValleCoCPA

Referrals are the best way to show your satisfaction.

http://www.vallecpa.com

Image

—

Posted: August 5, 2013 in Uncategorized

Tags: accounting, book keeping, business, cpa, Divorce, finance, Mediation, tax

Divorce Mediation

Posted: August 2, 2013 in UncategorizedTags: Alimony, Certified Public Accountant, Child custody, Divorce, Divorce in the United States, financial planning, Law, Mediation, separation

What is Divorce Mediation?

Divorce mediation is a confidential, informal, and voluntary process in which a specially trained, neutral mediator guides you through your entire divorce. Agreements are reached which meet the needs of all family members. When there are children involved, the primary focus is on their best interests. The end result is a complete legal divorce which never requires going to court.

Types of mediation:

- Comprehensive Divorce Mediation – Nearly every divorce involves four primary issues; 1) identifying and distributing the assets; 2) identifying and distributing the liabilities; c) determination of spousal support (alimony) and child support (if applicable) and; d) if children are involved, the creation of a parenting plan (child custody). James Valle & Company, CPAs provides a comprehensive divorce mediation service to assist the parties in reaching a Marital Settlement Agreement (MSA), which sets out all of the agreements reached on the four major issues. Once the MSA has been approved and signed by all parties, it is filed with the court along with other required legal forms, and becomes an order of the court, resulting in a full legal divorce.

- Financial Mediation – Some divorces involve complex financial issues which are the only barriers to an otherwise uncontested divorce. A Certified Public Accountant with an MBA from a top rated university and extensive entrepreneurial and corporate experience can assist the parties in understanding the important issues, help determine asset valuations, advise the parties on income tax implications, and assist with financial planning. This includes assisting in determining how to evaluate and distribute property, manage debt, or restructure jointly held assets and liabilities. We help overcome the emotional attachments and non-financial barriers which prevent reaching an agreement. We focus on reaching a Marital Settlement Agreement which will maximize the combined net worth of the parties in a fair and balanced way.

- Single Issue Mediation – Occasionally we encounter the fortunate couple who have the state of mind to resolve all but a single issue in their divorce. We strive to assist the parties to accurately and succinctly identify the issue and then work closely with them to reach an agreement on the resolution. These issues include but are not limited to, child custody (parenting agreements), child and/or spousal (alimony) support.

- Martial Business Mediation – The valuation, distribution and post dissolution operation, of family owned and operated businesses can be one of the most challenging and highly contested issues in a divorce. Our Certified Public Accountants are highly trained MBAs with extensive entrepreneurial and corporate experience. They have a proven track record of solving highly contested business disputes. We understand flexibility in financial reporting for closely held, family run businesses and can help decipher the underlying values while taking into account fully discretionary spending patterns. We can assist in the tax planning and compliance of the underlying transactions and coordinate any multigenerational issues.

- Other Agreement Assistance – Legal Separation Agreements, Temporary Separation Agreements, Modification of court orders, Marital Agreements (Premarital and Post Marital), Cohabitation Agreements and Domestic Partnership Agreements.

More information at: http://www.vallecpa.com

@JamesValleCoCPA

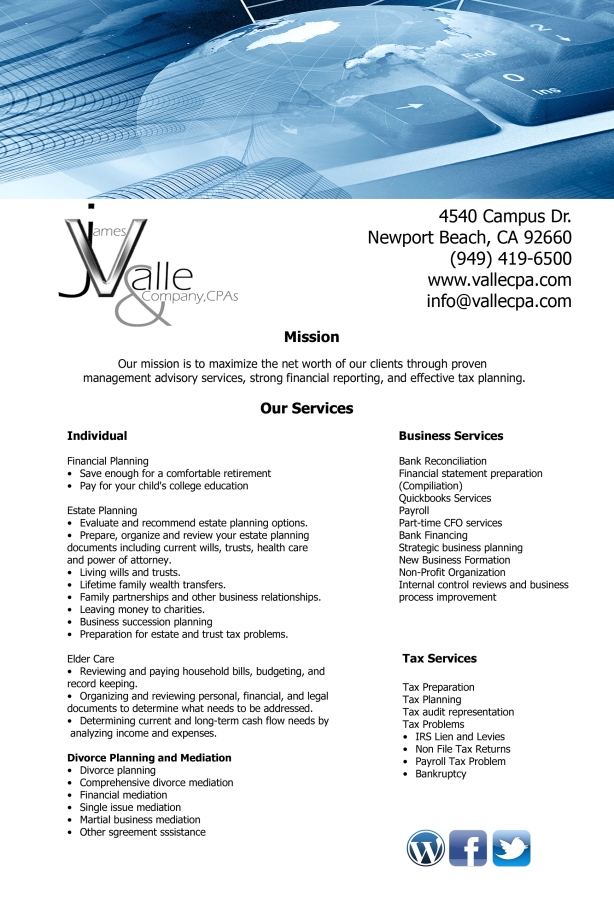

James Valle is the founder and senior executive of the company. He has accumulated over 30 years senior executive level experience in his CPA practice, publically traded and privately held companies. He has created many successful companies from the concept stage to significant operations. His industry experience is broad and includes service, manufacturing, defense, aerospace, telecommunications, power generation/transmission/distribution, retail and restaurant industries.

Mr. Valle’s goal is to create wealth for his clients by leveraging his vast industry experience in strategy and operations with his firm’s solid foundation of tax, accounting, and finanacial planning, The combined resources of his firm enable James Valle & Company, CPA’s to become a valued partner assisting their clients in increasing their profitability and maximizing individual wealth.

James Valle is a KPMG trained, California Certified Public Accountant. He holds an undergraduate degree in Business Administration with an emphasis in accounting from the University of San Diego and an MBA from the University of California in Los Angeles.

Schedule and appointment to get your questions answered.

4540 Campus Drive Suite 118

Newport Beach, CA 92660

Fax: (949)250-3012

Phone: (949)419-6500

info@vallecpa.com

Image

—

Posted: July 29, 2013 in Uncategorized

Thinking of Starting a New Business?

Posted: July 29, 2013 in UncategorizedTags: business, business startup, company, finance

Approximately 54 percent of Americans aged 18 to 34 want to start their own company, but just 8 percent of them own businesses. Not everyone in the 54 percent know or have the education on how to start a business. It takes more than just an idea.

Starting a business involves planning, making financial decisions and building strategies. Here are the steps to getting your business started:

1. Write a business plan. It is like painting your idea on canvas and showing it to the world. What are the details that you would need for this big picture? There are three major things: balance sheet, income statement and a cash flow analysis.

2. Choose a business location. This is crucial to the success of your business. Take note of your competitors, flow of traffic, crowd trends and geographical features.

3. Understanding your financial needs. Estimate the cost to start your business and how to get finance for it. This is where your Business Plan comes in handy. Pitching the right information to investors is the key.

These are not the easiest 3 steps but if you make it through the hurdle, everything else will flow together. The toughest will be writing an attractive business plan to appeal to investors. The more details you can provide, the better.

Image

—

Posted: July 17, 2013 in Uncategorized

Tags: accountant, cpa, finance